Running a business isn’t easy. One of the toughest challenges is managing working capital. Some businesses may not have enough cash or liquidity and become dependent on debt, while others may not be utilizing their cash properly to maximize return. Of course, there is no defined amount for any one business or industry. All businesses and industries are different, but they fundamentally all provide a product or service, and need to make sure they receive cash payment for those goods and services to be sustainable.

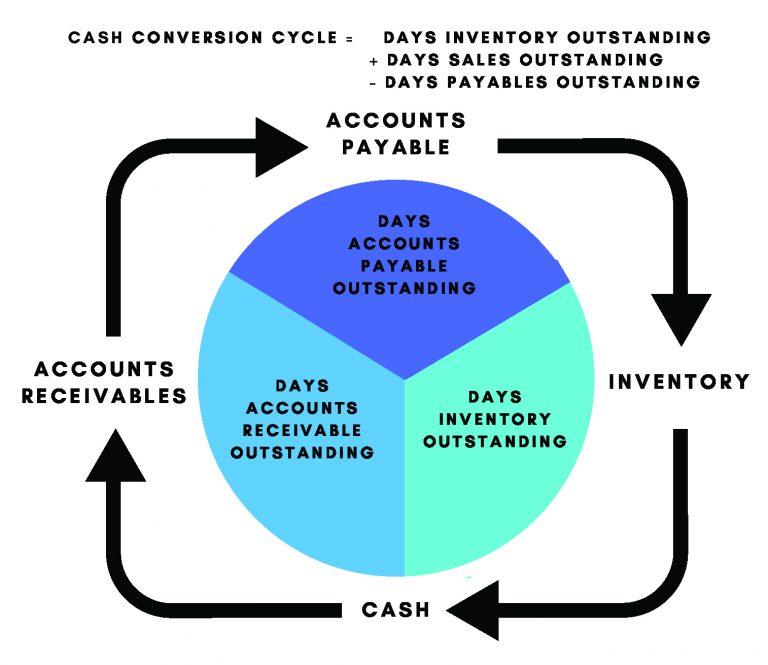

One of the best ways to measure how well a company is managing working capital is through the Cash Conversion Cycle (CCC). The Cash Conversion Cycle is the number of days it takes a company to convert cash on hand into inventory, and back into cash again.

The metric and its importance to the overall health of the business may sometimes get overlooked. Essentially, the quicker a business is able to receive cash for their sold inventory, the sooner they are able to utilize it for the next product cycle. This reduces the need to borrow, and management may be able to take advantage of supplier discounts.

A typical business has the following three main components to their cash conversion cycle:

- Accounts Receivable (A/R) Days Outstanding – divide the receivables balance by the last 12 months sales, then multiply the result by 365 (the number of days in a year)

- Inventory Days Outstanding – inventory balance, divide it by the last 12 months cost of goods sold, and then multiply by 365

- Accounts Payable (A/P) Days Outstanding- use the company’s accounts payable balance, divide it by the last 12 months cost of goods sold (COGS), and then multiply by 365

Cash Conversion Cycle = A/R days Outstanding + Inventory Days Outstanding – A/P Days Outstanding

In a perfect world, there would be no delays converting goods to cash. Unfortunately, there are customers who have delayed payments, and some inventory doesn’t leave the warehouse as quickly as we would like. This is where a relationship with your bank is important in figuring out the right amount of credit to alleviate the cash squeeze of those delays.

A line of credit is typically what a bank would recommend for working capital management. Lines of Credit are designed to temporarily fund working capital, while waiting for cash payments from the customer. Additionally, banks can provide assistance through cash management products. Cash management products are designed to speed up delivery of payments, both to suppliers and from customers. The intent is to reduce the number of days that cash is tied up in the sales process or CCC. Commonly used products include:

- Remote Deposit

- Merchant Services /Credit and/or Corporate Cards

- Lockbox Deposits

- ACH

Managing working capital has it challenges, but you don’t have to figure it out alone. Consult with your banker regarding cash management tools. Be sure to weigh the costs and benefits for the products prior to implementation.